Explain Diversification and Its Different Types of Diversification Strategies

Internal growth or organic growth is when a business expands its own operations by relying on developing its own internal resources and capabilities. This article will discuss the various growth strategies and explain the differences between them.

Product Diversification Learn About The Strategies Of Diversification

Newly introduced species can damage the balance of an ecosystem.

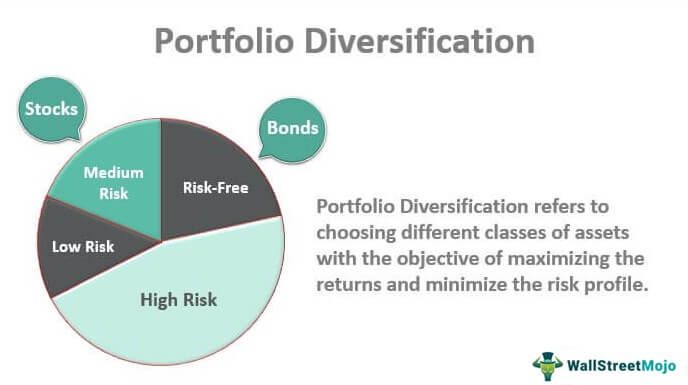

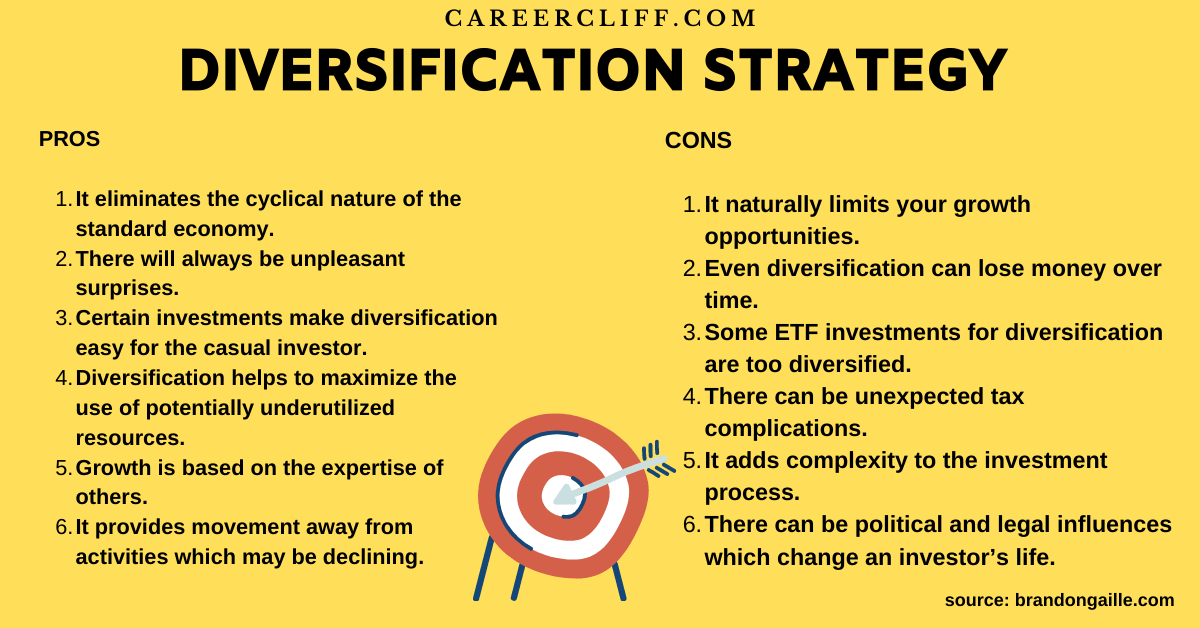

. The returns from investing tend to be higher but there is the risk your investments could decline in value. Diversification in turn can be classified into three types of diversification strategies. Dr Hanlon has expertise in the strategic application of social media for business and.

Since there is a lot of competition among banks to attract customers therefore it has triggered several innovations. Most of the Ig diversification occurs by gene conversion in the bursa of Fabricius. Also important for growth investing is portfolio diversification to reduce the risk in multiple stocks rather than to invest a lump sum in one growth stock.

Instead Mintzberg concludes that there are five types of strategies. Market development and horizontal and vertical integration and diversification. 35 Issue 5 SepOct.

An organizations structure is typically represented by an organization chart often called simply an org charta diagram showing the interrelationships of its positions. A healthy ecosystem is one in which multiple species of different types are each able to meet their needs in a relatively stable web of life. However further Ig diversification is achieved by somatic hypermutation in secondary lymphoid organs From.

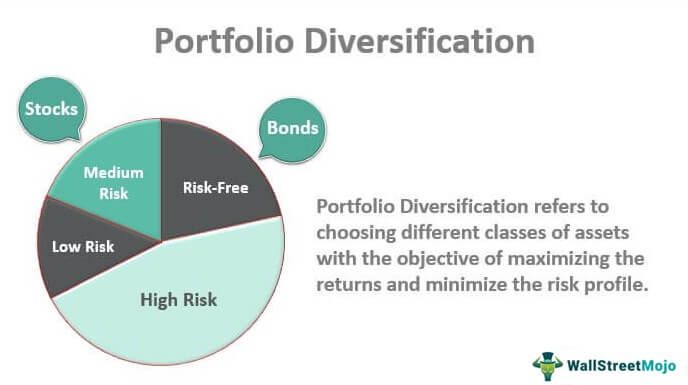

Any additional asset adds complexity and takes up space so there should be a very specific reason for every asset in the portfolio. The capital adequacy ratio is a measure of a banks capital maintained to absorb its outlying risks. Diversification is the allocation of financial resources in variety of different investments and has also long been understood to minimize such risk.

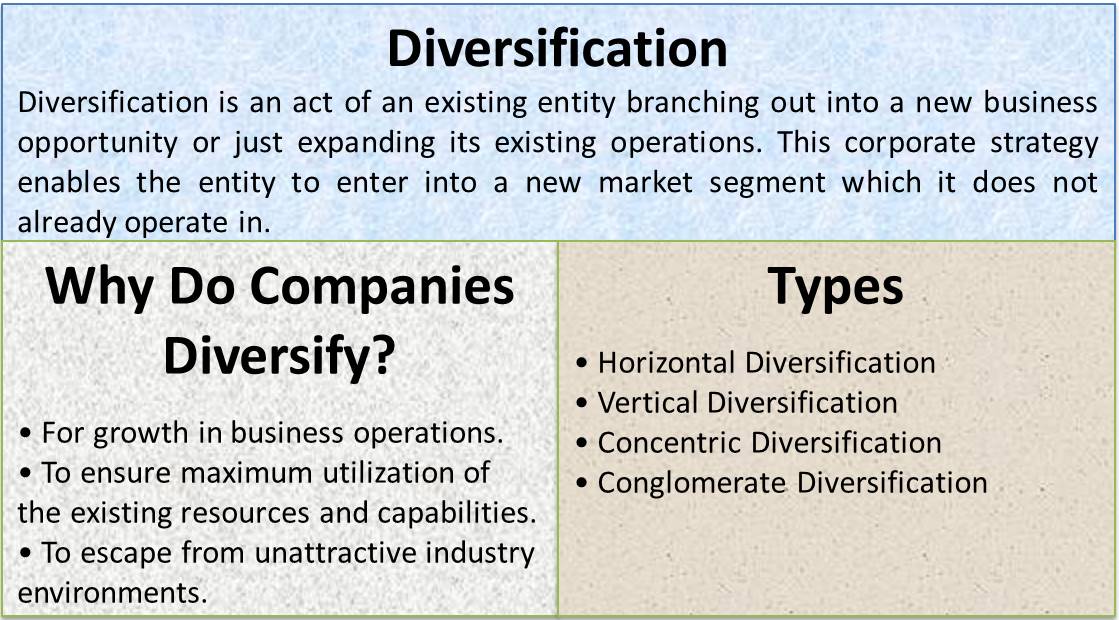

The main types are. International diversification as an important strategic option to achieve growth. Be able to apply the three tests for diversification.

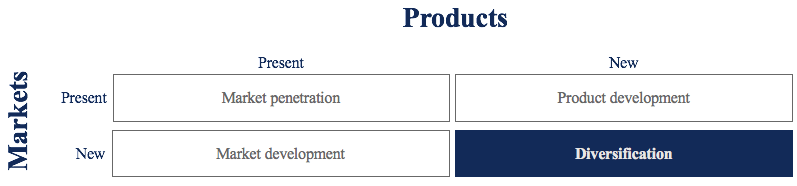

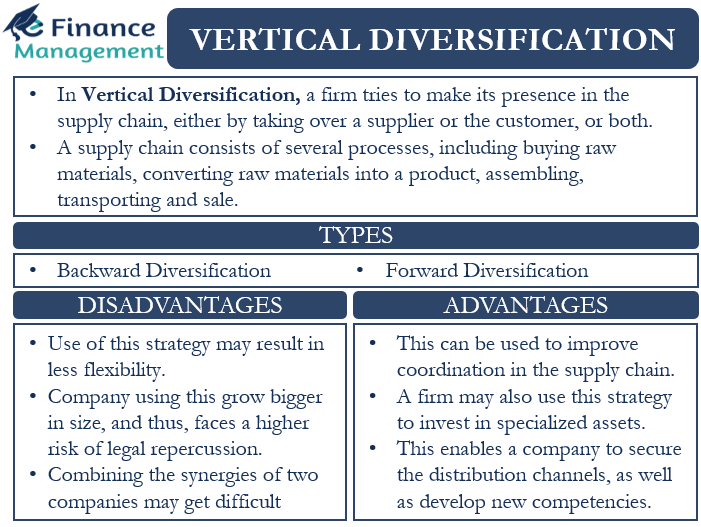

Strategy as plan. By understanding the organizational types that Mintzberg defines you can think about whether your companys structure is well suited to its conditions. While vertical integration involves a firm moving into a new part of a value chain that it is already within diversification requires moving into an entirely new value chain.

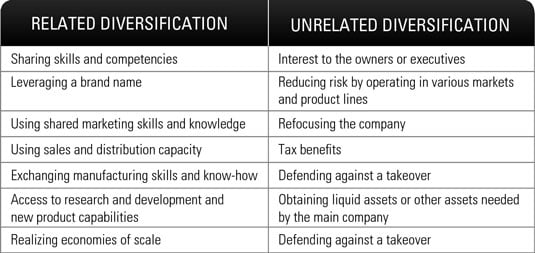

Explain the concept of diversification. Thankfully broad low-cost index funds make this easy. Distinguish related and unrelated diversification.

The topic area brings some of the much talked about theories and models into action such as The Uppsala Internationalization Process Model Network Theory International Entrepreneurship Theory as well as some interesting and significant phenomenon of todays business world such as. How to move into. We dont want to be diversifying for.

By the end of grade 8. What is more not just buying multiple stocks only in the tech industry or just in emerging markets but across several different sectors or markets. Organisms and populations of organisms are dependent on their environmental interactions both with other living things and with nonliving factors.

Types of Organizational Structure Organizations can be structured in various ways with each structure determining the manner in which the organization operates and performs. There are many different types of diversification and for the most part its likely beneficial to utilize them all. You would currently need a return on.

Different structures arise from the different characteristics of an organization and from the different forces that shape it which Mintzberg calls the basic pulls on an organization. In his 1965 classic Corporate Strategy he developed gap analysis to clarify the gap between the current reality and the goals and to. He felt that management could use the grid to systematically prepare for the future.

Annmarie Hanlon PhD is an academic and practitioner in strategic digital marketing and the application of social media for business. Diversify but diversify purposefully. Arteries - carry blood away from the heart.

Firms using diversification strategies enter entirely new industries. Explain the roles of financial markets Distinguish between real and financial assets Define and explain money market instruments zero-coupon and coupon- bonds and features Identify the cash flows associated with fixed-income securities Define and explain bond market features List the different types of Treasury securities and explain pricing and. B-lymphocytes produce three classes of antibodies after exposure to a.

What Is Diversification Of Business Strategies Definition Examples Video Lesson Transcript Study Com

Vertical Diversification Meaning Types Examples And More

Ansoff Matrix Diversification Strategy

Strategic Planning Diversification Dummies

Diversification Strategy Ispatguru

Portfolio Diversification How To Diversify Your Investment Portfolio

Diversification Strategy Definition Types Of Diversification Strategies

Corporate Level Strategy What Is Corporate Level Strategy And By Batur Seker Medium

Vertical Diversification Strategy Ceopedia Management Online

Diversification Strategy Examples Advantages Approaches Career Cliff

Corporate Strategies Of Diversified Companies

Understanding Portfolio Diversification The Motley Fool

Ansoff Matrix Diversification Strategy

Diversification Strategies Mastering Strategic Management 1st Canadian Edition

Diversification Strategies Mastering Strategic Management 1st Canadian Edition

What Is Diversification Advantages Disadvantages Types

Diversification Via Acquisition Creating Value

Diversification Strategy Definition Types Examples Pros Cons

Comments

Post a Comment